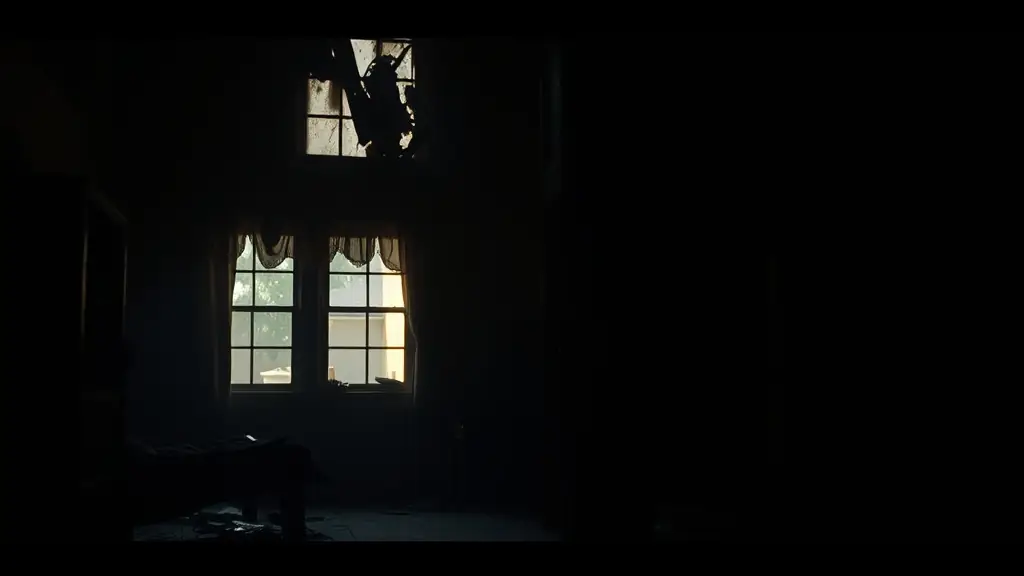

Filing a fire damage claim can be a daunting process, but understanding the basics can make it easier. First, it’s essential to document all damages thoroughly, including photographs and a detailed list of lost items. Insurance companies often require this information to process your claim efficiently. Additionally, knowing your policy details can help you understand what is covered and what is not.

Once you have gathered all necessary documentation, the next step is to file your claim with your insurance provider. Be prepared to answer questions and provide further evidence of the damage. It’s also wise to keep a record of all communications with your insurer. This can help resolve any disputes that may arise during the claims process.

Finally, consider hiring a public adjuster to assist you. They can help negotiate with the insurance company on your behalf, ensuring you receive a fair settlement. With the right support, you can navigate the complexities of fire damage claims and get back on your feet more quickly.